Introduction:

Cryptocurrency, once hailed as a revolutionary force poised to reshape the financial landscape, has experienced a rollercoaster journey since the inception of Bitcoin in 2009. Over the years, digital currencies have captivated the imagination of investors, technologists, and the general public alike. However, as we navigate through the dynamic world of finance, it’s essential to question whether the era of cryptocurrency is over or if it’s just entering a new phase of evolution.

The Rise and Fall (and Rise Again) of Crypto:

The early years of cryptocurrency were marked by enthusiasm and rapid growth. Bitcoin, the pioneer of the movement, saw unprecedented gains, sparking the creation of numerous alternative coins (altcoins) and blockchain projects. However, the euphoria was short-lived as the market experienced sharp corrections and increased regulatory scrutiny.

The infamous boom and bust cycles of crypto have led skeptics to question the sustainability of the entire ecosystem. Price volatility, security concerns, and regulatory ambiguity have contributed to a sense of uncertainty surrounding digital assets. Yet, despite the setbacks, cryptocurrencies have shown remarkable resilience.

Adoption and Integration:

One of the key indicators of the vitality of any technology is its level of adoption. Cryptocurrencies have gradually infiltrated mainstream finance and commerce. Major companies and financial institutions have started to explore and integrate blockchain technology. Bitcoin has been accepted as a form of payment by a growing number of businesses, and institutional investors are increasingly allocating funds to digital assets.

The Deeper Impact: Blockchain Technology:

Beyond the price fluctuations of individual cryptocurrencies, the underlying blockchain technology has proven to be a transformative force. The decentralized and secure nature of blockchain has applications far beyond digital currencies. Smart contracts, decentralized finance (DeFi), and non-fungible tokens (NFTs) are just a few examples of how blockchain is reshaping industries such as finance, gaming, and art.

Regulatory Landscape:

Regulatory clarity has been a significant factor influencing the trajectory of cryptocurrency. Governments worldwide are grappling with how to regulate this emerging asset class. Some nations have embraced digital currencies, providing a regulatory framework to encourage innovation, while others have taken a more cautious approach. Regulatory developments will undoubtedly play a crucial role in shaping the future of cryptocurrency.

The Future of Crypto:

As we contemplate the future of cryptocurrency, it’s crucial to acknowledge that the landscape is still evolving. While challenges persist, including regulatory uncertainties and technological hurdles, the potential benefits are too compelling to be ignored.

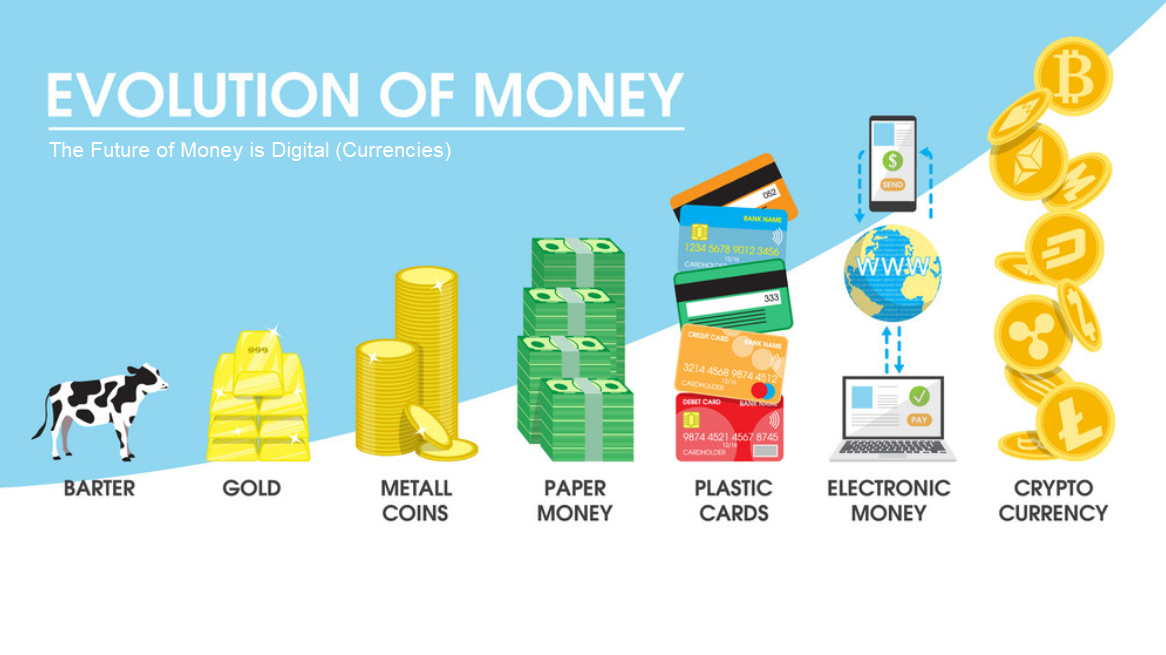

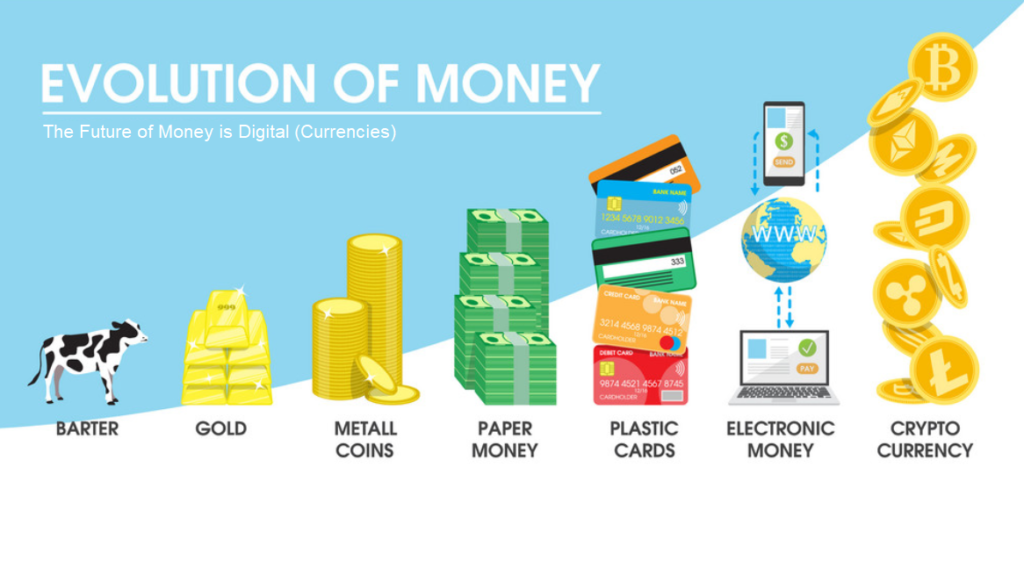

The concept of a decentralized financial system, free from the constraints of traditional banking, remains a powerful idea. The ongoing development of blockchain technology, coupled with increasing adoption, suggests that the crypto journey is far from over. It may well be that we are witnessing the early stages of a long-term transformation in the way we perceive and interact with money.

Conclusion:

So, is crypto over? The answer is a resounding no. While the crypto space has weathered its fair share of storms, the underlying technology and the principles driving its development remain robust. The evolution of cryptocurrency goes beyond price speculation and market trends. It encompasses the maturation of blockchain technology and its integration into various aspects of our lives. As we move forward, it’s not a question of whether crypto is over but rather how it will continue to shape the future of finance and technology.